Teaching Kids About Money: 11 Nifty Tips For Unearthing Your Child’s Inner Billionaire

Teaching kids about money can feel like an overwhelming task, but it is one that is crucial to ensure that your child knows how to manage their money well later in life. That’s why we’ve used the experience of many of the teachers here in the Third Space Learning office to provide you with 11 ways and activities to teach children about money!

Teaching kids about money – why is it so important?

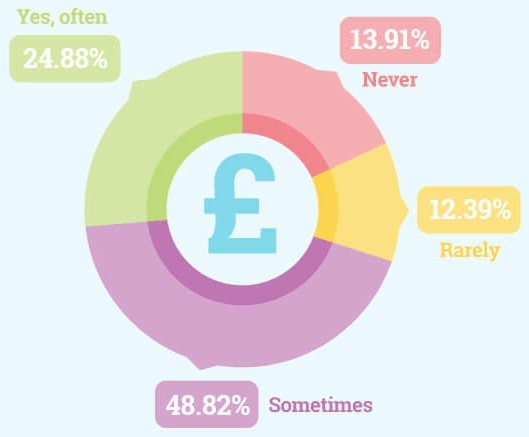

As outlined below, when asked, ‘Do you ever discuss savings or the importance of money with your child?’ about 75% of us admit to not talking about this critical subject:

However, with research indicating that our spending habits are formed by the time we reach 7, it’s important to think about how best we can pass on money skills to our children at an early stage. Here are our top home learning tips, activities and games you can use to help your kids learn about money in a fun and engaging way.

KS1 Maths Games and Activities Pack

A FREE resource including 20 home learning maths activities and games for years 1 and 2 to complete on their own or with a partner.

Download Free Now!1) Encourage children to count coins

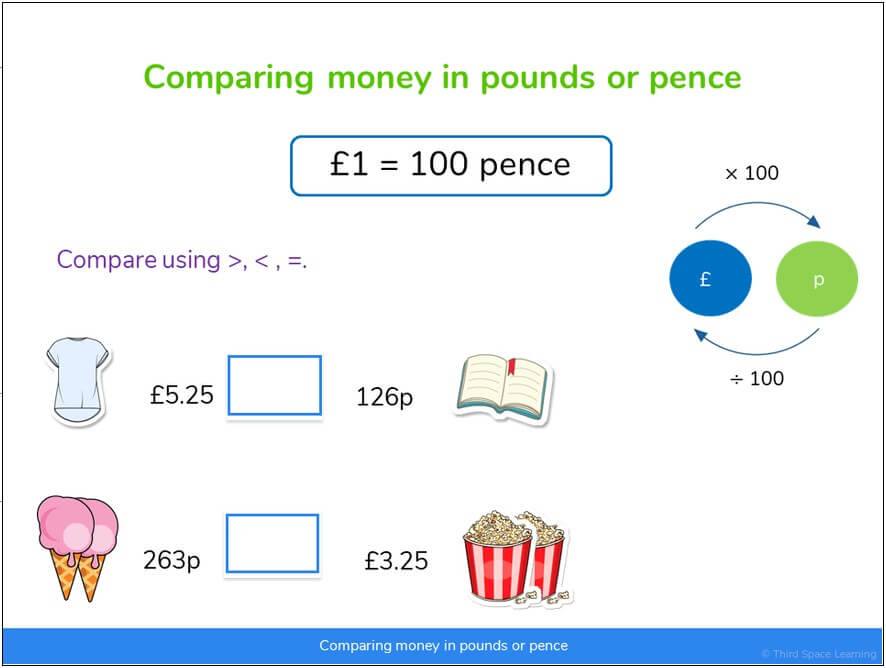

One of the hardest things to convey when beginning to teach kids about money is the value of coins. With some coins looking similar to unfamiliar eyes, think the 1p and 2p, the 20p and the 50p, it is important to make sure your child has grasped the basic concept of what each coin is worth.

If you are wondering how to teach your child the value of money then you will be pleased to hear that there are a number of things you can do. The most simple of which involves laying out all denominations of coins and talking your child through each one and its value.

If however you are looking for a simple money game for your child, the following is a good one to start with:

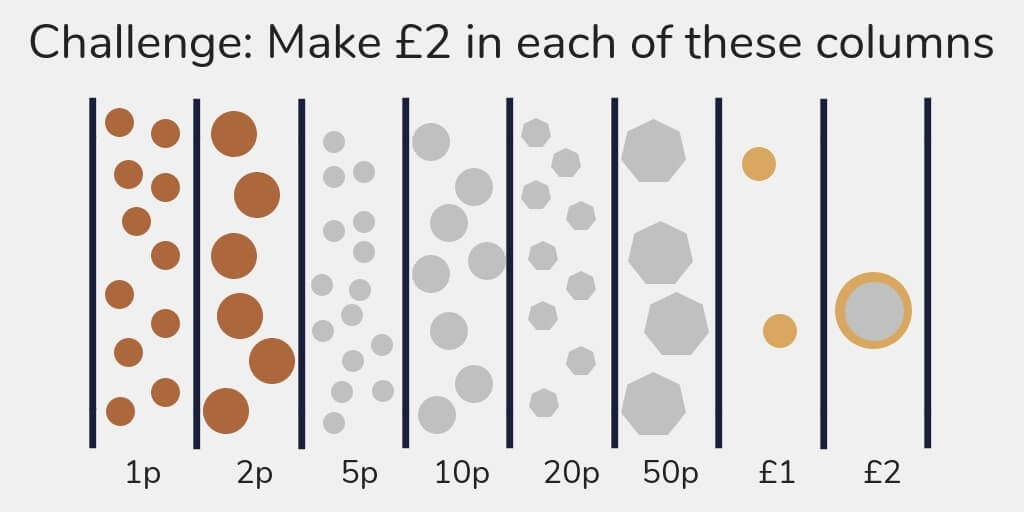

Step 1: Gather lots of coins together with your child (1p, 2p, 5p, 10p, 20p, 50p, £1, £2)

Step 2: Choose an amount of money you are going to make using all of the denominations of coins available (we recommend £2 to keep the number of coins needed to a minimum)

Step 3: Show(or let your child work out) how many of each coin is needed to make the desired amount. E.G you will need 200 1p coins to make £2, two £1 coins to make £2 etc.

Step 4: Let your child visualise the values of the coins. To reinforce the concept, ask them to try building their own piles.

2) Go shopping together

Teaching kids about money should involve giving them an idea of how much things cost, as this can definitely be an issue when you are out shopping with your child. We’ve all had a conversation that goes something along the lines of:

“Mum/Dad, can I get that toy please?“

“It’s very expensive. Have you seen how much it costs?”

“No, I don’t know. I just want it!”

Thanks to years of balancing the budget, as adults we know that expensive items are treats, however, many children have not yet been introduced to the concept of understanding how much things cost.

To help overcome this, take your child shopping and show them the cost of different items. When at the shop, involve them in decisions and explain your choices. Make sure to bring cash. Let them count out the money and hand it over to the cashier so they begin to think about the process of spending. Ask them to check the change after so they get used to the mental calculations required.

All of this should help them begin to realise that whilst money = items when in a shop, different amounts of money means you can buy different amounts of items. Sometimes teaching kids about money means going back to basics to ensure key concepts are grasped.

3) Rather than giving an allowance, consider giving your child a commission instead

Whilst the giving of an allowance, or pocket money, is common in many homes across the UK, you could consider giving your child a commission instead. By doing this, instead of simply giving them money for no real reason, you will be paying them for the chores they do around the house like cleaning their bedroom, vacuuming and washing the dishes.

This will help them to realise that money is earned instead of simply given to them, and is a good mindset for children to get into early in life.

It is a small change to something you may already be doing, but it is one that will help prepare your child for a pocket money free future!

4) Dig behind the couch and save pennies

Give your child a glass/clear plastic container so they can start storing their commissions and learn about the concept of saving. It is important that you use something clear or transparent as this means that your child can see the money increase each week and grasp the value in setting aside money.

Remember, there’s no better way of teaching kids about money than giving them visual examples.

If you’d like to go further, you could provide separate jars for each coin. You could then ask questions such as: ‘Which jar has the most value?’ Though the 2p jar may have the most coins, it probably won’t be as valuable as the one-pound coin jar.

5) Take a trip to the bank

This tip may not seem like the most exciting day out to your child, but they will definitely thank you in the long-term!

Take them to the bank and open up a savings account under their name. This process will help to illustrate the differences between digital and paper currency. Once their savings jar is full, go back to the bank so they can deposit their funds!

6) Hold a cake sale

Do some baking with your child and hold a cake sale to raise money for charity. Ask them to set the prices for each item and question their choices. For instance, outline that items possess varying values and the reasons why you may spend more or less on certain things. Allow them to handle money with customers and set them the challenge of counting how much you’ve raised at the end.

There are a lot of different questions you can ask them during this process to help them understand many different facets of money management. Examples include:

- Which cake should be the most expensive?

- Which cake cost us the most to make?

- How much shall we charge for each cupcake?

- Do we do any deals? If all the cupcakes cost 60p each, could we sell a box of 6 for £3 to make people buy more?

Many more questions will come up as your bake sale runs on, but these are a few examples to get you going!

7) Pause for thought when it’s time to pay for a meal

Can your child help when you pay the bill at a restaurant?

Whilst it may be a little mean to try to split the cost of the bottle of wine with them when they were only drinking juice, a restaurant presents a good chance to teach children about money.

You could discuss which card is best to use: debit or credit card, and explain the positives and negatives of different methods of payment provide. This will be a valuable life lesson.

Whilst your child will not be coming into contact with a credit card of their own for many years, it is crucial that they understand cards are not a way to access “free money” and that eventually, they will have to pay for whatever they have bought.

8) Get every member of your family involved with discussions about your household budget

Involving your child in some of the basics associated with your household budget will help to illustrate the importance of money.

Can they help you work out what percentage of your income goes towards bills?

Can they calculate how much this leaves for other activities?

If you are feeling brave, you could ask them to come up with ideas for reducing spending in certain areas.

All this will help them with their own budgeting as they get older. Take a look at this video by the Money Advice Service for further ideas:

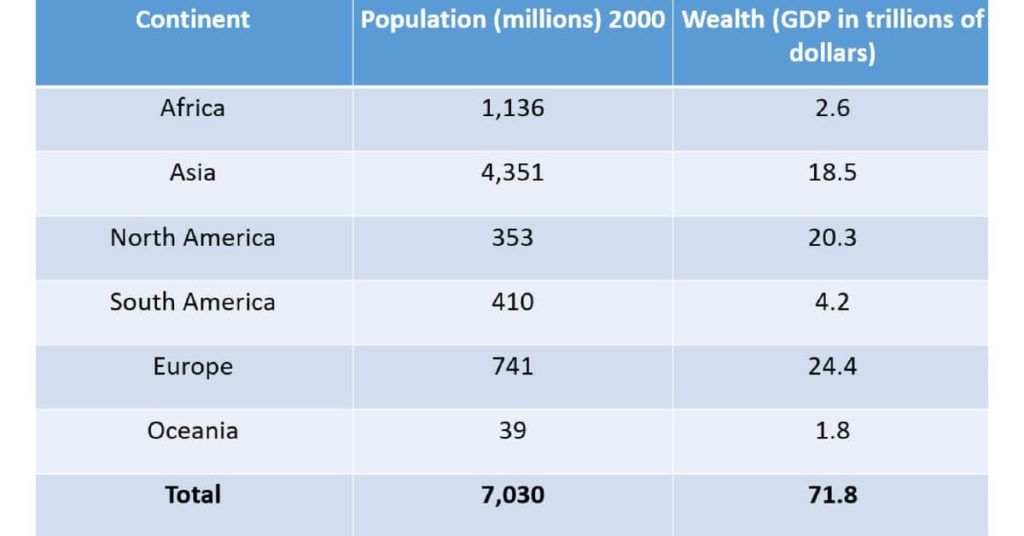

9) Explore money in the context of the wider world

Though money makes the world go round, there is considerably more money going around in some areas of the globe than others.

Helping your child understand the differences in global wealth will not only enhance their understanding of money but also provide them with some useful general knowledge. The following information might help to get you started:

There are a number of questions that could be inspired by such figures, not least why some parts of the world have lots of wealth despite having a smaller population.

10) Introduce the idea of opportunity cost

Put quite simply, this means showing your child that if they spend all their money on item A, they cannot have item B as well. In an ideal world, we would all be able to buy that new TV, sofa and dining table, but as adults, we know that this isn’t possible (until those lottery numbers come in anyway…).

That is why this is such an important concept to introduce to your child.

11) Introduce the 24 hour rule when it comes to impulse buys

A surefire way to help when teaching kids about money is to tell them about the 24 hour rule they should use when out shopping.

“Those shoes are amazing and I want them. Get we buy them please?”

This is a question that many of us have faced, with primary school aged children being masters of capitalising on the impulse buy, especially with someone else’s money!

To overcome this, let your child know that they are free to use their hard earned commission to buy it, but only on the proviso that they wait 24 hours and still want it then.

More often than not they will either forget about the purchase or decide that it doesn’t look as great as it did a day ago, and you can then use this as a teaching moment to show them why impulse buys are often not the right choice!

Teaching kids about money – The most important tip of all

One of the most important things to remember when considering financial education for children is that as a parent, you are setting an example for them about how to handle their finances later in life. We understand that it can be difficult to juggle the often hectic parenthood with additional teaching, but to ensure your child knows how to successfully manage their money when they are older, taking the time to show them now is well worth it.

Related Articles:

Free Home Learning Resources And Maths Packs For Primary Maths (KS1 & KS2)

DO YOU HAVE STUDENTS WHO NEED MORE SUPPORT IN MATHS?

Every week Third Space Learning’s maths specialist tutors support thousands of students across hundreds of schools with weekly one to one tuition designed to plug gaps and boost progress.

Since 2013 these personalised one to one lessons have helped over 150,000 primary and secondary students become more confident, able mathematicians.

Learn how pupils make accelerated progress or request a personalised quote for your school to speak to us about your school’s needs and how we can help.